In the ever-evolving universe of digital assets, investing in cryptocurrency has transcended mere speculation—it’s become a technologically driven venture where mining machines reign supreme. Particularly in the United States, the wholesale acquisition of Bitcoin mining rigs has emerged as a compelling choice for entrepreneurs and investors looking to carve a piece of this digital gold rush. But what makes buying Bitcoin mining machines in bulk a strategic edge? To uncover this, we must journey through the vibrant landscape of cryptocurrencies, the mechanics of mining, and the sprawling infrastructure of mining farms that power the blockchain economy.

Bitcoin, the pioneer of decentralized digital currency, continues to dominate market cap and public imagination. Behind every transaction verified and recorded on the blockchain lies the strenuous work of mining—a process where miners deploy high-performance computing rigs to solve complex cryptographic puzzles. These rigs, often composed of custom-designed ASIC chips, consume substantial electricity yet are irreplaceable for securing the blockchain and minting new bitcoins. For investors fluent in technological nuance, buying mining machines wholesale means scaling their operation quickly, leveraging economies of scale, and gaining a competitive cost advantage in the energy-intensive race of mining.

Beyond Bitcoin, other cryptocurrencies like Ethereum and Dogecoin introduce fascinating variables into the mining ecosystem. Ethereum, traditionally favoring GPU miners, is stirring waves with its anticipated shift to proof-of-stake, which could dramatically influence demand for mining hardware. Dogecoin’s rapid rallies bring to light the allure of alternative coins (altcoins) and necessitate diverse mining strategies. For wholesale buyers, such fluctuations underscore the importance of flexibility—purchasing mining rigs capable of adapting across cryptoeconomies or optimizing for different algorithmic demands can be the difference between profit and loss. Hosting mining machines in data centers specialized for optimized cooling and minimal downtime further amplifies operational efficiency.

Mining farms, the sprawling facilities housing hundreds or thousands of rigs, epitomize industrial-scale cryptocurrency mining. These farms leverage economies not only in purchasing hardware wholesale but also in negotiating energy contracts, often tapping into renewable sources to mitigate environmental impact and cut costs. Within the US, states like Texas and Washington have become hubs due to favorable power rates and regulatory climates. Investors purchasing wholesale mining machines are better positioned to expand or upgrade their mining farms quickly, ensuring they remain at the cutting edge of technological innovation and competitive in a volatile market.

Technology aside, the wholesale market in Bitcoin mining machines thrives due to its direct impact on scalability and resilience. Smaller players often find the upfront cost of acquiring, installing, and maintaining these sophisticated rigs prohibitive. Yet large-scale purchasers can access discounts, firmware customizations, and dedicated technical support from manufacturers. This boosts mining efficiency and opens pathways to hosting solutions—where companies manage the physical rig maintenance, network stability, and energy consumption on behalf of clients. Such services are pivotal for investors keen on privacy, security, and uninterrupted mining operations across diverse cryptosystems including BTC, ETH, and several altcoins.

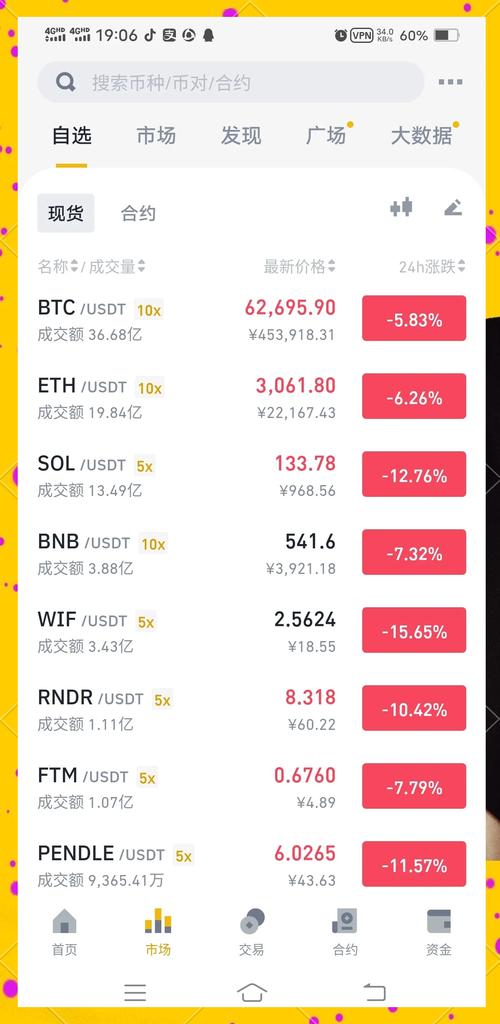

Crucially, the choice to invest in wholesale mining equipment couples well with broader strategies involving cryptocurrency exchanges and portfolio diversification. While actively mining delivers a stream of coins, exchanges offer avenues to trade these assets in real time—hedging against volatility or engineering arbitrage opportunities. Wholesale buyers often integrate their mining outputs directly with exchange platforms, optimizing their overall market position. This symbiosis between hardware investment and financial maneuvering is a hallmark of modern cryptocurrency enterprises, where mining rigs are not just machines but gateways to multifaceted economic playbooks.

To encapsulate, investing in Bitcoin mining machines wholesale in the US is more than a procurement decision—it’s a dynamic strategy at the crossroads of technology, finance, and energy markets. With careful navigation of these intersecting domains, investors can unlock substantial benefits: cost savings, enhanced mining output, adaptable infrastructure, and access to advanced hosting solutions. As the cryptocurrency horizon expands—powered by innovation and fierce competition—those equipped with scalable, efficient mining rigs stand poised to capitalize on the next wave of digital currency evolution.

Leave a Reply